TFO testifies against the business lobby’s wish lists

December 13, 2022

In its final “Legislative Days” before the new House and Senate are sworn in, TFO was invited to describe Oregon’s tax structure in a hearing of the House Committee on Economic Development and Small Business. Appearing with the tax lobbyist from Oregon Business and Industry, Jody Wiser countered pleas that the legislature turn the tax code upside down on behalf of semiconductors and businesses broadly.

First up was Oregon Business Council President Duncan Wyse, who sketched the August report of the Oregon Semiconductor Competitive Task Force. The task force, which got off the ground last winter, has a roster of business and higher-ed personages and elected leaders (no public-interest groups) and is staffed by the Oregon Business Council. Wyse emphasized acting fast to grab a share of federal money from the CHIPS Act, by which Congress intended to generate domestic production.

In questions following Wyse’s pitch, three legislators asked about education and workforce development. None spoke to business subsidies.

OBI’s Scott Bruun introduced a study the lobby had commissioned from the accounting firm Ernst & Young purporting to show the tax burden Oregon had imposed on business in recent years. The share borne by business, E&Y contended, had grown by a quarter as a share of state domestic project from fiscal 2019 to 2021. E&Y also mixed in income taxes imposed in Portland, Multnomah and Metro to claim that business taxes in Portland had grown by a third.

The study is glib in aggregating the various tax increases across different jurisdictions and defining the share borne by “business.”

Jody, sitting beside Bruun, began by addressing the ways in which the federal and state governments have slashed business taxes over the last four decades. The federal tax code has allowed business to avoid paying corporate income taxes by reorganizing as pass-throughs, LLCs, partnerships, REITs, etc., whose owners don’t pay tax at the entity level, only as individuals.

At the state level, Oregon has gifted business with exceptions unavailable to individuals:

- Over phases completed in 2005, Oregon slashed taxes for manufacturers that sell production outside of Oregon by adopting the “single sales factor,” dropping payroll and property from the apportionment formula. The 2019 CAT tax also is based only on Oregon sales, so global companies like Nike and Intel pay little.

- In 2013 and again in 2021, the legislature reduced tax rates for pass-through entities.

- Under Enterprise Zones and the Strategic Investment Program, businesses are exempt from property taxes for 3, 5 or 15 years. All kinds of businesses get these exemptions.

- Under Urban Renewal Zones and the Industrial Site Readiness Program, the cost of new infrastructure for businesses is shifted from businesses to residents or the General Fund.

What hasn’t changed: Oregon has no sales tax, a significant factor in business-to-business transactions.

Jody then turned to the consequences of the myriad provisions that the committee has unveiled in draft bills for 2023. “If the legislature were to increase tax subsidies for business, the money would come from one of two places: reduced services, or increased tax burden for employees.”

The draft bills, which are pitched as part of the package subsidizing the semiconductor industry, would be available to business broadly, with no targeting to semiconductor businesses.

“To the extent the legislature increases subsidies for semiconductor expansion or anything else, we urge it to adopt a budget and use the appropriations process, not the tax code. The Governor’s Strategic Reserve Fund is a nimbler instrument for directing expenditures to gather federal CHIPS funded businesses to Oregon . . .

“The tax credits and reimbursements in your committee bills are likely to result in runaway expenditures, as happened with the Business Energy Tax Credits.” BETC, as a diminishing number of legislators remember, became a scandal after the legislature expanded it in 2006 and 2008, before terminating the program 2014.

Finally, she addressed the E&Y report. “We find it a narrow, cherry-picked collection of factoids. Its main contention, that Oregon has moved from a low-tax state to average, is because the legislature and the voters have increased funding for K-12 education [the CAT] and mandated benefit standards like paid family leave and health insurance. Like all other taxes, the new levies of recent years pay for something: public goods. The OBI report says nothing about that.”

TFO’s full statement is available here. A recording of the hearing is here.

We are analyzing the bills that industry wants in the next session. None has a cost estimate.

We’re also developing support for our offensive agenda. More on that in the weeks to come.

More subsidies for the semiconductor industry?

November 18, 2022

The star-studded “Oregon Semiconductor Competitive Task Force,” chaired by Ron Wyden, Kate Brown and the CEO of Portland General Electric industry includes industry, government and academic boosters intent on promoting a more inviting climate for semiconductor companies. Since the task force issued its “initial report” in August, TFO has been teasing facts from fiction, comparing its wish list to the more than $2 billion in subsidies Ohio and New York gave Intel and Micron, and communicating our findings to state and local officials.

The Task Force wants new tax credits, more industrial land and aid to industry-focused job training. Considering the task force’s origins and composition, that’s not surprising. But we’ve been urging legislators, ahead of the 2023 session, to examine the incentives the state already provides to Intel and others, its capacity to give more, and whether and how devoting significant additional resources to one industry fits into Oregon’s economic vision.

In our conversations with legislators and in testimony to Washington County commissioners, we note that Intel, the state’s largest private employer, pays almost nothing to the state or Washington County:

- Over phases completed in 2005, Oregon slashed taxes for manufacturers that sell most of their production outside of Oregon by adopting the “single sales factor” (dropping payroll and property from the apportionment formula)—as advocated by Intel, its greatest beneficiary

- The CAT applies only to sales within Oregon, a tiny fraction of Intel’s in-state output

- Its Strategic Investment Program agreement with Washington County exempts Intel from millions of dollars in property tax; the state reimburses the county for some lost revenue

- Oregon has no sales tax, a benefit worth $6 to $9 million on every $100 million spent on building materials or equipment

In recent years Intel has reported annual revenue and net income exceeding $70 billion and $20 billion, respectively. Almost none of it pays for Oregon’s K-12 and higher ed the company depends upon.

Intel’s decision to build a fab in Ohio was wise—not because of the largess the state bestowed on it but because Intel wanted to expand its geographical footprint. But the Santa Clara-based company’s strategy is not part of the narrative in Oregon. Instead it’s that the state and local governments should do more for the semiconductor industry—much more.

The report presents assumptions about the amount of tax revenue expansion would bring—assumptions it does not explain. Unless legislators dig into the presentation, they may

throw more money at new fabs than they will generate in economic activity benefiting Oregon.

The report does not mention that with more fabs come demand for more housing and government services (education, transportation, health care, etc.). What plans would policymakers devise to address them?

One item in the report is the projection that 2,000 new jobs would generate $57 million in annual tax revenue. We suggest that the new hires be broken down to the number of jobs any particular business might commit to create. For example, Microchip Technologies, as it fishes for subsidies, says it will provide 650 high-wage jobs in Gresham. Ongoing revenue from 650 direct hires and additional suppliers, school teachers and fast food workers would generate $19 million a year—not $57 million. Policymakers should take note.

That’s just one of the details we’ve been investigating.

If you want to help with this work, let us know!

The Inflation Reduction Act is oddly named, but great tax policy

July 29, 2022

We hope The Inflation Reduction Act of 2022 actually makes it through Congress. It has some great tax policy in it, things we’ve been advocating at the national level for a long time. But despite the bill’s name, it is about reducing wealth inequality more than reducing inflation.

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy (ITEP), says of the bill announced Wednesday by Senate Democrats.

“This is a transformational change for U.S. tax and energy policy. The bill restores sorely needed and long-overdue accountability to our tax code. By ensuring that all corporations pay at least 15 percent of their profits in taxes, providing funding to the IRS to improve tax enforcement and reduce tax evasion, and funding clean energy and emission reductions, this bill would begin creating a more equitable America and a more sustainable planet. We call on every member of Congress to support this pathbreaking legislation.”

The bill includes President Biden’s proposal to restore $80 billion of the enforcement budget that has been cut from the IRS over the past decade, which will more than pay for itself. As ITEP has explained, years of budget cuts have caused the IRS to reduce its audits of very large corporations in half and reduce its audits of millionaires by even more.

“Even those opposed to changing our tax laws should agree with the commonsense notion that corporations and the richest Americans should follow tax laws already on the books. This proposal gives the IRS the tools to ensure that happens,” continued Hanauer.

The 15 percent minimum tax for corporations, the biggest revenue-raising provision in the bill, would address the problem of corporate tax avoidance that ITEP has documented for years. President Biden frequently cites ITEP’s conclusion that 55 large, profitable corporations paid no federal income taxes in 2020, at the height of the pandemic.

The tax law enacted by President Trump and Republicans in Congress in 2017 did nothing to address corporate tax avoidance. ITEP found many companies that were profitable each year from 2018 through 2020, the first three years that the 2017 tax law was in effect, either paid no federal income taxes during that time or paid an effective rate of 10 percent or less. A report from Sen. Elizabeth’s Warren’s office using ITEP data shows that the 15 percent minimum tax will limit the special breaks and loopholes these corporations use to avoid paying taxes.

Tax Fairness Oregon uses resources from ITEP often.

Like what you’re reading?

Bringing Candidates Up to Speed on Tax and Revenue Issues

July 25, 2022

Members of the TFO Steering Committee have been meeting since May with candidates running for the Oregon Legislature. Our goal? To help them understand some basic tax and revenue issues that they will be facing if elected.

Of the 75 districts up for election in November, 24 are guaranteed to be won by newcomers, many of whom may have limited knowledge of Oregon’s tax system and financial structure.

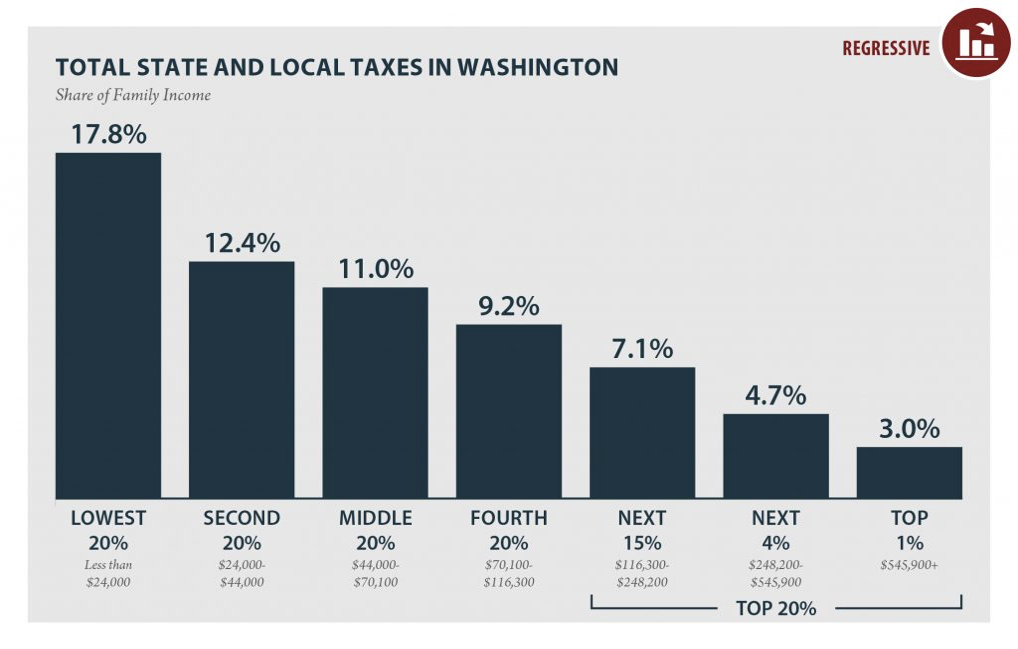

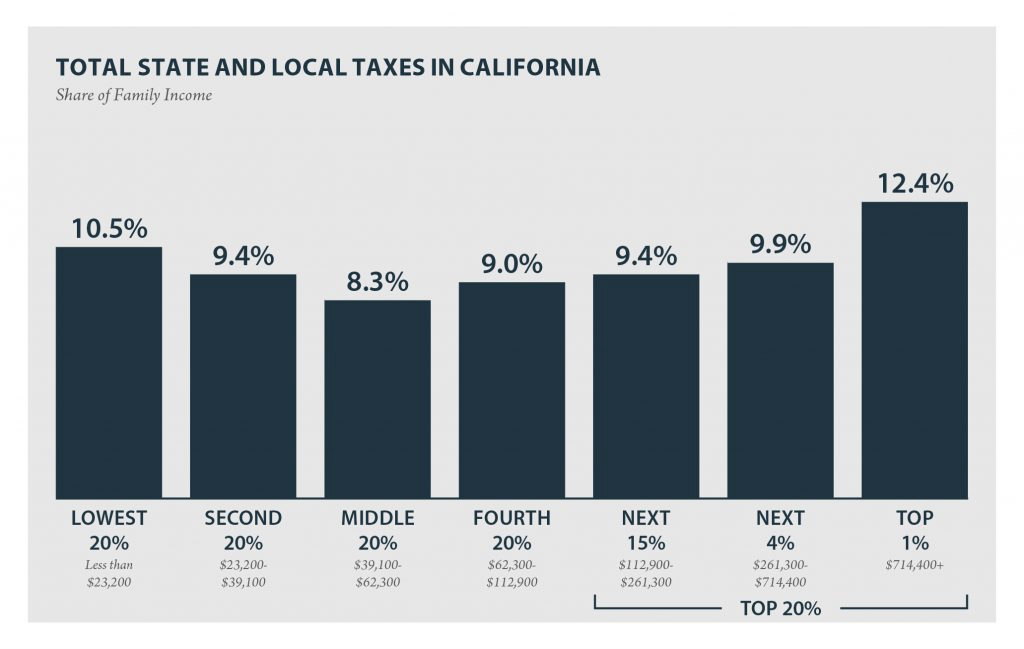

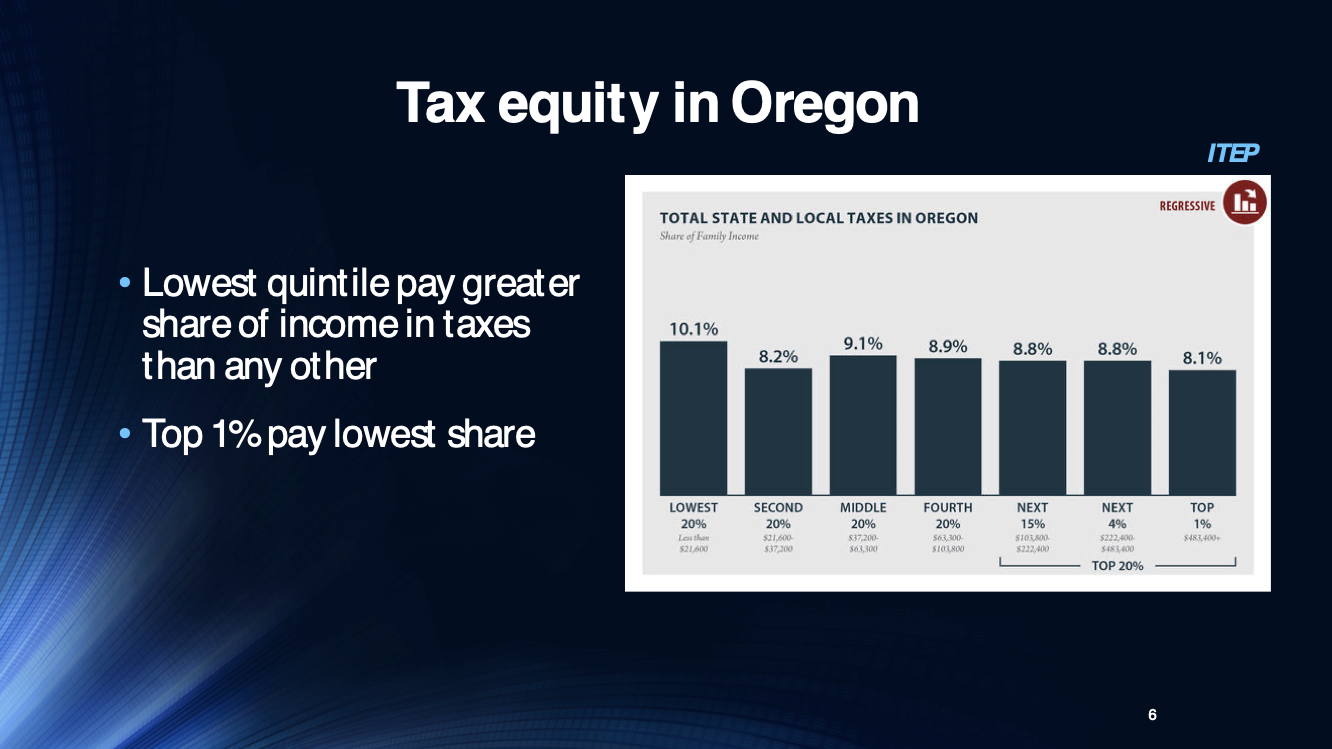

TFO uses this PowerPoint TFO Revenue Basics 2022 as we discuss Oregon’s tax policy principles and funding mechanisms. Our presentation includes these charts that show how Oregon compares to our neighboring states, in terms of tax fairness by family income bracket. The charts were prepared by the Institute on Taxation and Economic Policy (ITEP) in 2018, so they are a bit dated. But it’s clear if one reads ITEP’s Who Pays that Oregon sits geographically between the most regressive state and the most progressive state in the nation according to their analysis. ITEP includes state and local income, property and sales taxes along with fees in their analysis.

Oregon is in the middle—more progressive than Washington, but less Progressive than California.

Our intention is to help potential legislators consider who wins and who loses when tax code choices are made.

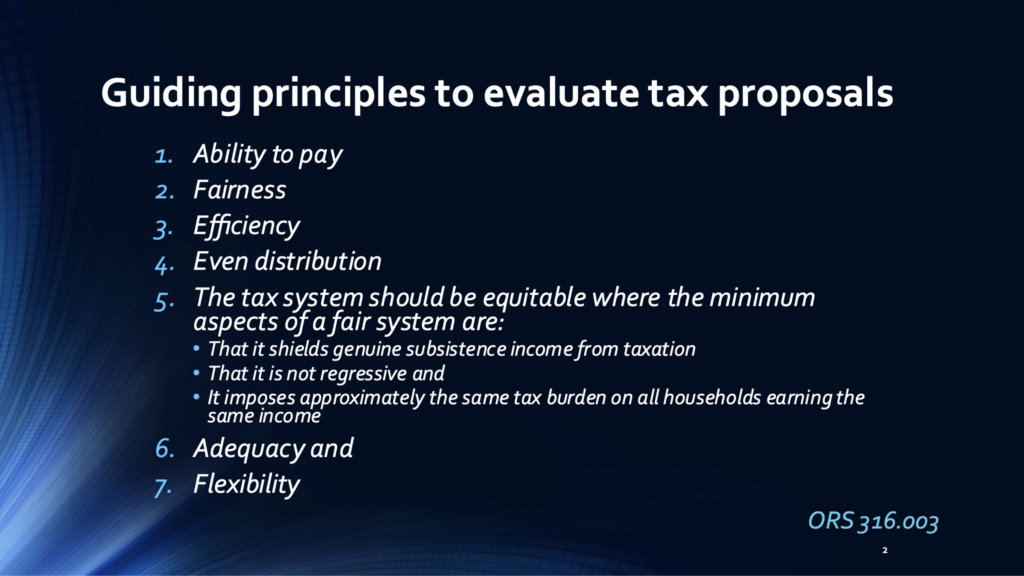

We also point out that TFO’s objectives are in alignment with Oregon’s tax policy law:

To learn more or to help TFO with these efforts, please give Josie Koehne a call at 503 866-3346.

Sine die: Never were we so relieved

March 10, 2022

We anticipated that the 2022 short session would be all defense, and for the most part we kept the forces of greed from scoring. It was a smile to hear Chris Allanach, the able civil servant who heads the Legislative Revenue Office, tell House Revenue Chair Nancy Nathanson (D-Eugene) that her committee had completed its business for the session after the brief work session that sent to the floor the modified omnibus tax bill, SB 1524.

Starting out in the Senate Finance Committee, the bill was like a blob in a horror movie, picking up viruses over 16 days of consideration, threatening the integrity of the tax code each time Chair Lee Beyer (D-Springfield) added something to it. Beyer has been a business and development cheerleader throughout his career, and over the past decade, in a second stint in the Senate, he chaired the Business and Transportation Committee. When Finance Chair Ginny Burdick resigned in November, President Peter Courtney appointed Beyer to succeed her. He retires at the end of the year.

We wondered about the terms Beyer and Nathanson set in divvying up committee bills. Short-session procedures restrict their numbers, so sometimes diverse provisions that in long sessions get discrete consideration get combined into one vehicle. Nathanson took three items: forestry taxes, including the governor’s “forest accord”; an inflation adjustment for cannabis taxes; and an extension of the Historic Property Special Assessment. (She did so, generally in a conservative—small “c”—manner.) Beyer was to handle school funding related to the 2020 wildfires, the annual connection to the federal tax code, and a miscellaneous policy and technical bill, SB 1524. The Blob.

Gain Share

The Blob’s most controversial item was extension until 2030 of the Gain Share program, which since 2007 has sent General Fund revenue to localities that give property tax breaks to businesses through Strategic Investment Program agreements. Gain Share, most of which is lavished on Washington County, has had no formal review since 2015, when the legislature renewed it for nine years. It was scheduled for review in 2023, an exam its proponents sought to avoid. As did many legislators from Washington and other counties who would like their localities to take a bite of the General Fund.

We were among many opposing Gain Share (and as we reported last week, we had a piece in The Oregon Way explaining why). When the bill finally got to House Revenue March 1—seven days before adjournment—Nathanson explained her intention to delete the extension: Tax expenditures are supposed to be reviewed on a schedule and as part of a budget, not just because they’re popular. After presumably counting votes (or accommodating her colleagues), Nathanson amended her plan and proposed a one-year extension, until July 2025.

Beyer’s second bit of mischief would have extended to medical technicians an income tax credit provided to certain medical providers (doctors, nurses, etc.) in rural areas. The champion of the provision was first-term House Revenue Republican Bobby Levy (Echo). Levy told the Senate Finance Committee that some of her constituents in Morrow County, on the Columbia, had moved to Washington, so it was important to try to retain technicians in Oregon by opening the state’s wallet. We testified that the provision was unexamined and unjustified: The pandemic-induced chaos in the health care labor force is not confined to rural counties on the state’s border.

Nathanson, in opening her March 1 hearing, explained why she was excising Levy’s provision—the same reason she’d sought to remove Gain Share. No one on the committee protested.

A minor bit of Beyer largess is section 1 of the omnibus: increasing production subsidies disbursed by Oregon Film to moviemakers who shoot in the state (“Portlandia,” “Grim,” etc.). We testified against it in House Revenue, as we had in Finance, bringing data gleaned from the Department of Revenue: Of the $20 million the state spent this year to subsidize movies, $1.4 million went to the purchasers of the tax credits that finance the program. The top beneficiary in fiscal 2022 is US Bank: Last fall it bought $7 million in tax credits for $6.58 million, easing its Oregon income tax liability by $420,000. The top individual purchaser erased $258,000 in taxes.

The only member of either committee to question the provision was Rep. Khanh Pham (D-Portland), who asked Oregon Film head Tim Williams whether depleting the fund faster, as the increase in subsidies will do, would prompt him to return to the committee for an increase in total tax credits sold to finance it. (The legislature has doubled the volume since 2016.) Williams replied that it would be a good problem to have, but that he had no plans to do so. Uh-huh. We implored the committee to rethink how it subsidizes movie productions and eliminate the financing fee it gives to millionaire taxpayers. (Oregon Film helpfully explains how you can save up to 10% of your income tax obligations.)

The omnibus bill also addresses the closing of rural pharmacies by exempting certain independent stores from the CAT on prescription drugs. But the crisis in small-town pharmacies has nothing to do with the CAT and everything to do with the cartel of Pharmacy Benefit Managers that are strangling drug stores across the country. (Much of CVS revenue comes from its PBM subsidiary.) We told legislators that they might congratulate themselves for a feel-good measure (that depletes K-12 funding), even as pharmacies continue to shutter. The feds are on the case: In January the Department of Health and Human services proposed rules to address the PBM cartels.

Other revenue provisions

Nathanson added to the omnibus a provision to allow farmers loss carrybacks as compensation for their obligation under HB 4002 to pay workers time-and-a-half after 40 hours (an omission in the 1938 federal labor law because most farm labor at the time was Black). That debate occurred far over the heads of TFO and the tax committees (we lobbied against a separate provision giving farmers tax credits—in effect having the state pay for the overtime). That minority Republicans didn’t walk over the farmworker bill was something of a coup for a functioning legislature, though of course majority Democrats had to pay for it.

Most of the other bills we opposed died. Nathanson effectively killed two by declining to schedule votes. HB 4097, sponsored by five members of her committee, would have created a tax credit for volunteer firefighters. HB 4043 was an ill-conceived plan to retain low-income housing by giving tax credits to sellers if the new owners maintained modest rents. A provision in a veterans bill, HB 4066, would have provided 100% property tax exemptions for disabled veterans over 65. The provision was dropped to avoid referral to Revenue (and the bill died in the Senate).

Among bills on their way to the governor:

- SB 1502, which is part of a deal with the timber industry, creates a tax credit for certain small forestland owners in exchange for leaving the trees alone. But it has faults we hope to see corrected, like no sunset date and treating with kid gloves forestland owners who break the deal.

- HB 4055 extends the lapsed Harvest Tax. We have been urging the tax committees to engage in broader reform, recognizing the legislature’s hollowing out of taxes on timber and shifts in ownership structures over the past three decades.

- HB 4054, the historic property tax benefit reform, collapsed over design, technical issues and the politics of having two dozen interests at the table. One proposed reform, which would have limited the benefit to commercial property, fell by the wayside, even after The Oregonian published a story citing big tax breaks for the owners of multi-million-dollar homes in Portland. The committee settled for a two-year extension with modifications.

We supported SB 1506, allowing localities to ask their voters to raise cannabis taxes up to 10% to cover revenue losses from diversion into drug treatment under Measure 110, which passed in 2020. When that idea failed, Republican Senator Lynn Findley (Malheur) proposed a version that would allow only Ontario to ask its voters the question (the city is booming with pot shops serving folks from Idaho). After the bill died on the Senate floor, Nathanson proposed to insert Findley’s plan in the omnibus bill. But she didn’t have the votes either. GOP colleagues on her panel, Greg Smith (Heppner) and Werner Reschke (Klamath), praised her for trying.

We know the feeling. We had some successes. As is often so, we were the only opponent of a provision, and somehow it died, or got less worse. (Our testimony is on our website.) Nathanson appeared to be of like mind on many matters within her control.

As for us, our task is contesting a Gilded Age. We’ve begun planning for 2023.

Gain Share is a boon to Washington County—and a bane to the rest of the state

February 25, 2022

|

||

|

||

|

||

|

||

|

||

|

Week 3 in the Oregon Legislature: rushing to spend surpluses before we know we have them

February 17, 2022

We’re disappointed, if unsurprised, that the revenue committees are focused on tax credits and other giveaways. We aren’t shocked that the tax bills under consideration lack any guiding philosophy but represent a grab-bag of gifts to whatever constituency is squawking.

Number 1 on our Hit Parade, albeit a relatively small item, is HB 4097, which would give volunteer firefighters $1,000 a year through the tax code. It arises from anecdotes that, Gosh, surely the money would help attract volunteers. Never mind that fire fighting is a local responsibility paid for with local tax revenue, or that no one has studied whatever the problem may be. Five of seven members of the House Revenue Committee are cosponsors.

Number 2 is of consequence: a tax credit intended to maintain low-income housing by giving the credit to multi-unit owners who sell to new owners that pledge to maintain low-income rents for 30 years. HB 4043 has amendments that would improve the bill, but it remains a flawed way to preserve low-income housing.

Number 3 is the $16 million-per-year tax giveaway to Washington County under the “Gainshare” program. Stuffed into the Senate omnibus, SB 1524, the program (which dispenses $700,000 to seven other counties and nothing to 28) would be renewed ahead of its six-year schedule for renewal, meaning that no agency has performed review of its effectiveness. The legislature put sunsets on tax credits more than a decade ago to ensure real review of tax expenditures every six years. Senate Finance seems poised to let Gain Share jump past that hoop.

Number 4. The tax committees last year maneuvered the same advance renewal of this now $20-million annual subsidy for the movie industry. This year’s omnibus would provide that the reimbursements paid for every qualifying movie would be increased, thus disbursing the available funds from annual tax credit auctions to fewer movies than under current law. In Senate Finance on February 14, Alan DeBoer, a former senator from Ashland, brought up our February 7 testimony and described frustrating participation in the auctions, which the Department of Revenue administers. “Get rid of the tax credits. You’re just helping people that don’t need the money [to] pocket the money and pay less in taxes, which is contrary to our philosophy.” DeBoer urged the committee to abolish the tax credits and fund the industry through the Ways and Means process. Committee Chair Lee Beyer conceded that option was “not politically possible.” We assume that’s because Ways and Means has higher priorities—and the tax committees don’t.

These and other efforts to give away revenues come amid big budget surpluses. Oregon’s official economist projected February 9 that taxpayers may be in line next year for a nearly billion-dollar kicker, thanks to the state’s kookie constitutional provision that makes economic projections more important than the legislature’s budget. But the Office of Economic Analysis also warned that the budget is likely in for a shock when the Fed’s interest rate hikes have their intended effect on inflation, the economy—and government tax receipts.

Yet the mood in the legislature appears to be: What me worry?

The clever reality of tax expenditures in our Hit Parade is that the state never collects the taxes, so they don’t show up in the budget—they never existed. Outside the revenue committees, few legislatures pay attention to tax expenditures because, you know, tax is hard.

At least we’re not Mississippi (we say that a lot), where the legislature is intent on abolishing the income tax despite its citizenry ranking nearly last in nearly everything. Neighboring Idaho is on a similar jag. In Utah, Republicans are prepared to reject the Democrats’ proposed cut in the sales tax on groceries in favor of their own cut in income taxes. So things could be worse here.

As always, we urge you to write your representatives on whatever among these or other issues make you simmer.

Week 2 in the legislature: We have our work cut out for us

February 9, 2022

Our testimony before the Oregon Legislature is available on our website. We’re looking at bills and talking with their sponsors. We support some and are working to amend or kill others.

SB 1524 is the House and Senate tax committees’ omnibus vehicle for substantive and technical changes to law. Senate Finance held a hearing February 7, and we testified on two issues:

- Section 1 of the bill would increase the subsidy to individual films through the Oregon Film Office. Last year the legislature increased the total subsidy funded by the auction of tax credits from $14 million to $20 million; now the committee proposes to raise the percentage of a movie’s costs funded by taxpayers. It appears that since Oregon Film expects to be flush with cash after the next auction, it wants to push it out the door faster. Our real objection is the structure of the subsidy: In 2021, the legislature got $12.7 million in moviemaking with $14 million; the difference went to those who bought the tax credits, a no-risk investment in the form of reduced income tax liability.

- The -1 amendment concerns Gain Share, another dubious program that currently send $16 million a year to Oregon’s richest county (Washington) and $700,000 to seven other counties. There are other 15-year property tax exemptions that the General Fund does not reimburse. Advocates want to push through a six-year extension without proper review. We’re trying to stop it.

SB 1507 would create exceptions to the Commercial Activity Tax (CAT). Rural, independent pharmacies are closing across the state, and some legislators blame the ½% CAT. But their problem, in addition to the inflation that’s hurting everyone, is the monopoly control of middlemen known as Pharmacy Benefit Managers that dictate the price of prescription drugs. State economists have told legislators that the CAT’s funding for K-12 is less than projected. Creating more exceptions to the CAT would come at the expense of our kids’ education, which faces its own Covid-related challenges.

Other bills:

SB 1502 – Amend: A tax credit for small-woodland owners written with provisions that would likely cause other business tax credit programs to get expended to match it.

SB 1506 – Support: Allows localities to raise their share of the marijuana tax from 3% to 10%; Measure 110 shifted tax revenue from cities and counties for substance-abuse treatment. This bill will help backfill some of the lost local revenue.

SB 1569 – Support: Allows the collection of voluntarily disclosed ethnic and racial data on tax returns so that policymakers better understand who benefits. The Finance Committee approved the bill on February 7.

HB 4002 – Amend: The bill requiring overtime pay for farmworkers includes an employer tax credit; neither Washington nor California have found it necessary to subsidize overtime.

HB 4043 – Amend: The bill intended to encourage the retention of low-income housing at sale would give obscenely generous tax benefits to their sellers.

HB 4054 – Amend: The Historic Property tax bill was written too hastily.

HB 4055 – Amend: The Harvest Tax bill is critical to keeping the forest industry paying a least some tax until we get reform.

HB 4066 – Amend: Vets who are disabled would pay lower property taxes. The bill would be fairer with a different approach to the exemption.

HB 4079 – Still being drafted, the bill would create a sales tax on luxury products to fund basic support to low-income Oregonians, like foster kids aging out of foster care and single, pregnant women. In principle, TFO supports a broad-based sales tax with exceptions for groceries and other items common in other states, paired with a restructuring of income tax brackets to mitigate the harm to low-income Oregonians.

HB 4097 – Oppose: $1000 tax credit for “volunteering” as a firefighter. Local tax revenue should support local services.

Review our testimony at our website, write you legislators about your opinions on these and other bills. We’ll send alerts when we have time.

The short session: TFO’s watchlist

January 31, 2022

With the legislative session set to start February 1, we are reading bills and meeting with legislators, including two new members of the Senate Finance Committee.

Among the bills we’ll be working on:

Film industry subsidies. Tucked in an otherwise routine Senate omnibus bill, SB 1524, is a provision to increase Oregon taxpayers’ payments for qualifying film and TV productions. One item would double, to 20%, the taxpayer subsidy for payments made for employee wages, salaries and benefits for work in Oregon. The subsidy for “all other actual Oregon expenses” would be increased from 20% to 25%.

Timber. One bill would reinstate the harvest tax and increase it consistent with the governor’s “Private Forest Accord,” providing increased revenue for Oregon Department of Forestry and for forestry research at Oregon State. The second bill would provide funding to small woodland owners who incorporate increased protections to streams and rivers required of industrial timberland owners.

Cannabis. Two bills would change marijuana taxes. HB 4056 would index for inflation the amount of marijuana revenue going to treatment. SB 1506 would allow cities or counties to increase the tax for purchases made within their counties from 3% to 10%. The increase would draw Oregon taxes toward those of other states and help localities make up for the reductions resulting from Measure 110.

Low-income housing. A bill intended help retain low-income housing has us meeting with the bill sponsors to get it fixed. As drafted, it would give the seller of rental housing an Oregon tax credit equal to the entire profit on the sale if the housing units met low-income standards.

Tax committee changes.

The Finance Committee’s chair this year is Lee Beyer (D-Springfield), succeeding Ginny Burdick, who resigned last fall to take a seat on the Northwest Power and Conservation Council. Beyer, who is retiring at the end of his term this year, was long-time chair of the Business and Transportation Committee. Independent gubernatorial candidate Betsy Johnson lists him as an endorser. TFO knows him, and he knows us.

Two newly appointed senators are joining the Finance Committee.

Rachel Armitage (D-Warren) was appointed to succeed Johnson in the 5th district, predominantly in GOP-leaning Columbia and Clatsop counties. Armitage has staffed two Democratic legislators in Salem. She told county commissioners that she would not seek election in her own right when the term ends with the 2024 election.

Janeen Sollman (D-Hillsboro) was appointed to succeed Chuck Riley, who served on Finance and retired December 31. Sollman had represented House District 30 since her election in 2016; she ran opposed in 2018 and 2020. She’s known to us, and we’ve an appointment to speak with her soon.

Also departing the Finance Committee is Majority Leader Rob Wagner (D-Lake Oswego).

The House Revenue Committee has no membership changes.