What do you think of the kicker?

December 18, 2023

We think the Kicker is Oregon’s very worst tax policy. And it’s stuck in the Constitution, thanks to the Republicans who referred it to the voters 24 years ago. As one of you recently wrote, “no one, including the highest paid people in Wall Street, can accurately predict the state of the economy two years in the future.” I’ll add that “even someone living solely on Social Security will struggle to accurately predict their income for the coming two years.”

It’s hard to believe we’ll be getting nearly 45% of our taxes back because the growth of the economy wasn’t accurately anticipated.

This recent OPB article is one of the best summaries on the Kicker I’ve read.

I learned two notable things I didn’t know. Give it a read, and see what you learn.

And here’s where you can calculate your kicker. To what organization will you donate it?

Celebrating and supporting our work for Tax Fairness in Oregon

November 29, 2023

After all the pleas you received on Giving Tuesday, TFO sends its own on “Giving Wednesday.” We are grateful for your support. Below we’re sharing with you readers the fundraising letter we mailed to donors of record.

In the 2023 legislative session, members of TFO testified more than 70 times and had hundreds of conversations with legislators. We led the legislature to pass one bill of our design, contributed to the modeling of another, limited the damage of a third, and provided the rationale for killing dozens of bad ideas (no doubt some will be revived). You can read our submitted testimony at TaxFairnessOregon.net/legislative-testimony.

Since the session ended, we’ve continued to meet with legislators and plan for 2024. Several of us traveled to the Eastern Oregon Economic Summit in La Grande. We attended the Democratic Party’s biennial conference in Sun River, where we talked with legislators in a casual setting. And we’ve had published the occasional op-ed. Somehow the same argument we make in a one-pager carries more weight with legislators when printed in a newspaper.

The 2024 short session is not expected to consider much in the way of substantive tax policy. To elevate legislators’ understanding of the tax bills they consider, we have begun an effort to require a distributional analysis (showing who receives the benefits by income class) of every tax bill that goes to the floor. We’re also fighting a proposal to give more than $20 million to the owners of minor league baseball teams to help finance new stadiums—an example of misplaced priorities if ever we saw one.

None of us gets paid—which is one reason legislators trust us. But we still have expenses: dues, travel, research tools, our website. Which is why we’re writing: to ask you for a modest investment in our work.

You can donate online at TaxFairnessOregon.net or mail a check in the envelope included with this letter.

Thank you for your continued support.

The address for an envelope: 5550 NW Roanoke Lane, Portland, Oregon 97229

Do check out our updated website.

$20 million for the owners of the Hillsboro Hops?

September 27, 2023

On September 18, Jody Wiser’s OpEd was published in the Portland Tribune:

For the past 50 years wealth inequality has steadily worsened in the U.S. In Oregon, the top 10% own three times as much as the other 90%. While the Oregon legislature cannot solve a national problem, they don’t need to make it worse.

During the 2023 legislative session the legislature was generous in supporting numerous essential services—housing, mental health, and childcare. And they created a new Kids’ Credit. It will mean a lot to some poor families with young children. They’ll receive $1000 for each child under six. That’s a maximum of $5000 per family. But they did something even better for some rich families: those inheriting up to $15 million in farm or forest land may pay no Oregon estate tax on that property. That’s a maximum of $2,400,000 per family.

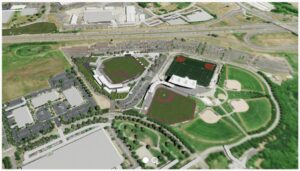

Now, according to an Oregonian story Stadium funding shortfall puts baseball team at risk of leaving Hillsboro, the legislature is being asked to step up and hand a few wealthy investors $20 million dollars. The owners of the Hillsboro Hops want the legislature to help build a new home for the team they own. The owners are offering $82 million of the $120 million cost. The city of Hillsboro has offered $18 million. They want the rest of the state’s taxpayers to pay the rest. While the new stadium would be owned by the City and used for concerts and other events, the current stadium already accommodates over 3500. The average Hops baseball attendance was only 2400 last year.

The current stadium is already used for concerts and other events, and still has debt to be paid which counts on that revenue. Clearly, the need for a new facility is a requirement for the owners of the Hillsboro Hops, not the other uses. The current stadium is only ten years old and if the effort to bring a major league team to Portland ever succeeds the prospects that the Hops will stay in Hillsboro, using either stadium is very weak.

Of course, the desire for baseball stadium subsidies might not end there. Major League Baseball has made new stadium demands of the A-level Emeralds in Eugene as well. The Emeralds have similar annual attendance: 136,000 for the Emeralds and 151,000 for the Hops. Will the legislature hand out another $20 million to help build an upgraded stadium there?

We hope legislators from the rest of Oregon will not be willing to send money from their taxpayers to support facilities for these private businesses in either Washington or Lane County. The facilities will provide little to no economic or social benefit to the rest of the state. Certainly, Washington County is not a depressed community needing funds to keep the economy going. Intel, Analog Devices recently announced major semiconductor expansion plans that will bring billions more in investment in the County.

Historically, privately owned teams have succeeded in getting the public to pay for their facilities. They defend their appeal with claims about economic activity and employment. JC Bradbury, PhD, a sports economist debunks these claims in So Your City Wants to Build a Stadium. Anyone who is tempted to consider the Hops’ funding request should read his article. He quotes University of Chicago economist Allen Sanderson who once said that “If you want to inject money into the local economy, it would be better to drop it from a helicopter than invest it in a new ballpark.”

Car dealerships get told they must improve their facilities just as have Oregon’s A-level baseball clubs. No one would think it is the legislature’s job to help auto dealerships. Likewise, the legislature does not help build movie theaters for Regal Theaters, grocery stores for Safeway, or dealer lots for Toyota. Why should the public provide facilities for owners of sports teams?

Hopefully our current legislative leaders have realized that this is just one more way we make the rich richer.

Agree with TFO or disagree, let your legislators know. By email, or by attending one of their town halls.

All legislative email addresses follow this pattern: Rep.firstnamelastname@OregonLegislature.gov or Sen.firstnamelastname@OregonLegislature.gov

Here are those links:

Oregonian, September 8, 2023

Global Sport Matters, June 15, 2022

https://globalsportmatters.com/business/2022/06/15/so-your-city-wants-sports-stadium/

Let’s stop increasing wealth inequality

September 6, 2023

For us, the last session brought some mixed emotions. We watched, helpless in the last hours when the legislature passed two bills with radically different impacts. One, the Kids’ Credit will mean a lot to some poor families with young children. They’ll receive $1000 for each child under six. That’s a maximum of $5000 per family, (if you’re either popping kids out frequently or in multiples). The other for families at the other end of the financial spectrum, those inheriting up to $15 million in farm or forest land can pay no Oregon estate tax on that property. That’s a maximum of $2,400,000 per family. To be clear, the existing law that Tax Fairness Oregon helped design and pass in 2012 already provided a $7.5 million exemption for these natural resource estates, but it had some constraints that the new law took away. Keep in mind that only 4% of Oregon estates pay any taxes.

The fact that legislators would pass such a huge benefit for a limited number of well-off families is demoralizing for those who think that wealth inequality is one of the biggest issues of our times, a contributor to homelessness and hopelessness and the kind of anger and depression that breeds gun violence and mental breakdowns. Of course, it also has a huge negative effect on our democracy and the vitality of local economies.

It’s led us to begin a series of meetings with legislators to talk about wealth inequality and the role legislators can play in exacerbating or reducing it though tax measures. Here’s the one-pager we’re leaving with them.

If you’d like to join us on a visit with your legislators, please give us a call. We’ll likely ask you to get it scheduled. We’re particularly interested in legislators outside the core Portland area.

Here’s the one-pager we are using with legislators: TaxCodeWealthInequality

Take action on HB 2083

July 22, 2023

TFO urges you to write Governor Kotek to ask her to veto HB 2083, a bill that would continue a tax benefit for Oregon’s wealthiest business owners.

The bill is among a string of benefits for the rich the legislature deemed worthy in the 2023 session. Kotek has signed SB 498, an estate tax bill that opens a loophole for billionaires to exploit the “natural resources credit” intended for small farmers. That action followed the resurrection of a dubious research and development tax credit and other benefits for businesses—packaged in a bill that in its final form dropped disconnection from federal Opportunity Zones, another boon for investors and landowners that was advertised (falsely) as an instrument of prosperity for low-income communities.

HB 2083 would extend a provision that allows business owners to get around the federal limitation on state and local tax deductions. Most taxpayers are limited to $10,000 in itemized SALT payments. But under the 2083 regime, the owners of LLCs and other business entities can, through a complicated election that is said to cost the state nothing, take unlimited federal SALT deductions.

TFO testified against the regime when it was considered two years ago and again in the 2023 session. (For the nerdy details, read our testimony.) Ours is a moral stand: Taxpayers who happen to be business owners should not have a tax break that Congress denied to taxpayers who happen to be employees (or coupon clippers). Income is income, and deductions are deductions—unless, of course, the legislature gets creative on behalf of—well, you get the picture.

That’s why we ask you to take action on HB 2083.

Defeats, modest wins and one total victory

July 6, 2023

The legislative session: defeats, modest wins and one total victory

It is hyperbole for an interest group to claim it achieved a particular legislative outcome. Many ingredients go into Salem Sausage over a six-month session. Tax Fairness Oregon sent 11 members to speak at 70 committee hearings and held hundreds of meetings with legislators and staff. Our often-lonely voice against bad bills perhaps gave a committee chair the backbone to say no to colleagues. And we drove one bill from its introduction to the governor.

We had four priorities going into the 2023 session:

- Minimize a resurrected research and development tax credit, which the business lobby began pushing for a year ago

- Reform Enterprise Zones and the Strategic Investment Program (SIP), which authorize localities to reduce property taxes for businesses

- Disconnect from the 2017 federal Opportunity Zones provision, which gives investors and landowners tax benefits

- Eliminate the tax credit auctions that fund a slice of Opportunity Grants for low-income college students

How’d we do?

The R&D credit was resurrected, but not as generously or broadly as the business lobby wanted.

Early in the session, former House Revenue Chair Phil Barnhart told Senate Finance Committee Chair Mark Meek why the R&D had been allowed to sunset in 2017. TFO followed Barnhart with testimony to its ineffectiveness at the state and federal level. Demonstrating that we don’t have a vote, the next day Meek championed a robust R&D in another committee stacked with industry supporters. It was an indication of how the session would go.

In a later Finance hearing and in meetings with scores of legislators, we submitted evidence that states’ R&D subsidies have no correlation with semiconductor research. Legislators pushed it anyway, ignoring Biden administration guidance warning states that handouts to companies would not boost their applications for federal subsidies.

After debate that ran through four committees until the last week of the session, the R&D provision, in HB 2009, installs a credit costing perhaps $25 million in the next biennium (and more than twice as much in those following). But only semiconductor research is eligible. The state will pay companies up to $4 million, at 15 cents per dollar of qualified expenditures (which also are deductible). Proposals for a more generous subsidy were dismissed, apparently at the insistence of House Revenue Chair Nancy Nathanson. The provision is a waste, but considering the drumbeat to give away more, it could have been worse.

The Oregonian has spent a year documenting abuses of the Enterprise Zones program: secret deals between county governments and corporate beneficiaries and the absurdity of giving tax breaks for Amazon and UPS warehouses (which must be near their customers) and data centers in Washington County (which consume scarce industrial land but provide little employment). We have long criticized the legislature for allowing counties to give away property-tax funding for schools, only to be reimbursed by the state and thereby drain school budgets statewide. The education unions brought political heft to our argument, even as many lawmakers backed their counties and the businesses that suck at the government teat.

Nathanson and Revenue Republican Greg Smith devised reforms, among them slashing the “Gain Share” subsidy, under which the state compensates localities for property tax abatements they give to business. Washington County gets more than 90% of state Gain Share payments, and many county reps in Salem defend it like Patrick Henry defends liberty. The payments survived unchanged in the give-and-take in the Joint Committee on Tax Expenditures.

HB 2009, bound for the governor, is a modest success. It eliminates tax breaks for warehouses but not urban data centers. It establishes a fee Enterprise Zone businesses must pay to compensate some losses to K-12. Under the three-decade-old SIP, required minimum property tax payments are indexed for inflation. The bill requires measured public disclosure of pending tax abatements. Overall, it resolved a vociferous debate between reformers (including TFO) and cheerleaders for the business lobby. The tally in Joint Tax reflected the balance, as both liberal Senator Jeff Golden and conservative Rep. Bobby Levy voted no.

Our bitter loss was the legislature’s failure, as in 2020, to disconnect from Opportunity Zones. We had gathered cosponsors for HB 3039, testified in House Revenue and Joint Tax, and gone head to head with the business lobby while our allies were mostly engaged elsewhere. We were excited when the disconnect—effectively requiring investors to pay taxes on O Zone profits just like any other capital gains—was included in HB 2009 as introduced by Nathanson and Speaker Dan Rayfield. Their intention was that the investor class pony up a little for all the generosity otherwise bestowed. But in the backroom, the advocates for the rich said no.

Speaking of the rich, Meek held a half-dozen hearings on bills to reduce the estate tax. The worst of them was SB 498, an idea hatched by Rep. Kevin Mannix to open a loophole for hobby farmers—people who diversify their portfolios with “natural resource property” (a tax carveout for small farms, fishing firms and timber owners)—to exclude part of their holdings from the estate tax. The bill went through multiple permutations as Meek worked with Republicans, settling on one that allows billionaires to exclude up to $15 million from the estate tax.

Republicans and the business lobby claimed the bill would save family farms—which are protected under a 2007 law TFO helped fashion. The Oregonian twice misstated current law and the bill as helpful to family farms. Meek’s bill appeared to have been part of the deal Democrats cut to get Senate Republicans to call off their six-week walkout. We spent two days in Salem during the final fortnight lobbying against it, with some effect. SB 498A split the Democratic caucuses: 9 of 17 senators and 20 of 34 representatives present—including Nathanson—voted against it on the floors. We have asked the governor to veto the bill.

TFO had one unalloyed victory that would not have happened had we not identified the inefficiency of tax credit auctions providing some of the funding for Opportunity Grants. We found that the auctions had cost students $3.8 million in grants over the past four years, the money instead going into the pockets of in-the-know taxpayers who bought the tax credits. It made no sense for the state to use a wasteful financing mechanism rather than appropriate all the money out of the budget like any other program.

Under current law, another round of auctions was scheduled for December. We sought amendment to a routine bill, SB 129, that would have extended the auctions for six years, instead ending them immediately. At the same time, we lobbied the Ways and Means Committee for months to increase funding to make up for the auctions. (It did, from $200 million to $300 million).

The amended bill unanimously passed Chair Michael Dembrow’s Education Committee in March and Joint Tax in June. In the final week, the Senate approved it 25-0, the House 45-7. The seven nays came from Republicans. Perhaps US Bank had whispered in their ears: Department of Revenue records, which were released to us after we appealed DOR’s refusal to disclose to the attorney general, showed the bank had profited $1.29 million over two years by buying tax credits.

Committees heard dozens of other bills. Most of the time we said: This is dumb, and it died or was amended. Occasionally we said: Sounds okay, and it passed. Sometimes we said: This is outrageous, and it was sent to the governor. But our points were acknowledged.

As when we opposed motherhood and apple pie in a Senate Finance hearing on SB 540. The bill would exempt $17,500 in military pensions from income tax for individuals younger than 63. Advocates said the bill, which would cut taxes by up to $1700 ($17,500 multiplied by the top marginal income tax rate), would spur new retirees with in-demand skills to move to Oregon. We said: For those already living here, isn’t it just a gift? Who’s going to disrupt their family and move to Oregon for an obscure tax benefit worth maybe $1700? What revenue would then pay for the services those residents require?

It’s dangerous to cross words with Patriots. Upon finishing our testimony, Chair Meek contended that a room full of veterans “would be very insulted by what you just said.” We’re used to it. Few others advocate a rational and equitable tax code.

The committee sat on the bill for three months, then passed it three days before sine die. The next day, we told leaders of the conflict between SB 540 and a provision the Ways and Means Committee approved: $220,000 to study veterans retirement taxation. The study money went through; SB 540 died.

The rare week: We favored proposals!

March 27, 2023

TFO had an extraordinary week: we testified FOR three bills. So in this report, we’ll set aside all the cockamamie proposals we’ve spoke against and celebrate the alignment of the stars. Three items on the proactive agenda we set at the beginning of the session had hearings.

Strategic Investment Program reform

Since the 2022 session, we’ve been studying the SIP, along with other property-tax abatement agreements that localities can offer in exchange for the promise of jobs and economic development. The SIP program, enacted in 1993, was aimed at “traded sector” businesses—generally manufacturers that produce goods for national and world markets. Think Intel’s chip plants. SIPs have saved businesses billions of dollars in taxes and fees. In recent years they’ve been used by wind farms, solar farms, data centers and big wholesale distributors that may or may not employ many people. The program has never had serious review.

We began urging reform with legislators last summer. House Revenue Committee Chair Nancy Nathanson and committee Republican Greg Smith introduced a bill, HB 3457, that would limit the SIP’s largess. Smith works as an economic development official in eastern Oregon and has first-hand experience with the agreements—and their use among companies that site operations near the Columbia for its wind, power, land and water. The tax breaks are gravy that don’t influence their location decisions, except when their negotiators pit counties against each other.

The tax breaks also harm K-12 schools statewide. Because of the school funding equalization formula, the state General Fund backfills property-tax abatements that reduce funding for school districts, and that reduces funding to other districts that don’t provide abatements. We’re robbing Peter to pay Paul. Our allies include teachers and other school employees who have watched funding decline for decades.

HB 3457 (and amendments expected) reflects points we’ve made. It would reduce the cost of property-tax abatements, projected to be more than $700 million in the next biennium, by raising the threshold values of the business equipment upon which the abatements are based. It would also index them for inflation.

Opportunity Zones “disconnect”

House Revenue also heard HB 3039, the Opportunity Zone bill TFO initiated in 2020. A watered-down version of the bill died on the floor when GOP leader Christine Drazan led her caucus walkout, ending the legislative session.

Under the bill, Oregonians would be required to pay income tax on their capital gains that are exempt from federal tax. Local development officials, anxious to entice real estate projects, have been confused by the jargon used to describe the bill, and they conveyed their confusion to Salem. Tax wonks call it a “disconnect” from federal law, and the supporters of O Zones either don’t understand what that means—or they exploit misunderstanding of what it means—in arguing that Oregon will lose investments if the state’s taxpayers are denied state tax breaks.

That’s not how O Zone markets work. The out-of-state investors who put money in our projects don’t pay Oregon taxes. And because 99 out of 100 O Zones are in other states (8,764 nationwide, 86 in Oregon), it’s reasonable to assume that most Oregon investors are putting most of their money in other states. Requiring them to pay state taxes would have a vanishingly small effect on projects in Oregon. All taxpayers get the federal breaks. We think the legislature has better uses for $50 million a biennium than handing out subsidies to the 1% for fancy hotels and office buildings in downtown Portland (or LA or Phoenix).

In 2020, when House Revenue held a hearing on the same bill, opponents said they “believed” it would hurt the state. Belief is not evidence. If you’re into evidence, read or watch our testimony, which begins at the 8:30 mark of the committee video.

Opportunity Grants

Opportunity Grants are the state version of Pell Grants for low-income college students. The program was initiated years ago. In 2018, the Revenue committees approved an addition to the funding, most of which is provided by the Ways and Means Committee through the regular appropriations process. The addition is a $14-million-per-year auction of tax credits, administered by the Department of Revenue.

In the 2022 session, we testified that the auctions were a wasteful way to finance programs, because the tax-credit buyers siphon a portion of the expenditure. Back then, we were talking about the auction that finances subsidies that the Oregon Film gives to producers of movies and TV shows. The Opportunity Grants auction works the same way. Over the past four years, the auctions have taken $3.7 million of the $56 million intended for students and given it to the auction winners.

SB 129, introduced as a routine matter at the start of the session, would extend the Opportunity Grants auction through 2029. We showed legislators that the auctions are a dumb way to fund a program, and the Senate Education Committee agreed, voting 6-0 to end them as of 12/31/2022. The Joint Committee on Tax Expenditures heard the amended bill Friday morning, capping our unusual week. TFO was the only witness. We’re hopeful the bill will sail to the governor’s desk.

We don’t anticipate another week like it, but we enjoyed our pause from being Debbie Downer.

Two dizzying weeks on economic development bills

March 8, 2023

Some legislative committees are focused on subsidizing every kind of business development imaginable—and some beyond imagining. Much of TFO’s focus in the second half of February has been countering the rush to give away our tax base.

We testified on Enterprise Zones, Gain Share, Regionally Significant Industrial Sites (RSIS) and research tax credits in four committees. The load has limited our bandwidth to work on amendments for flawed bills.

Reviving the R&D credit is the rage, despite all evidence that it has no effect on recipients’ behavior. As we have testified in Senate Finance and the Joint Semiconductor Committee (and as ally Oregon Center for Public Policy has written and testified), Washington and Oregon killed their R&D credit—and remain first and fourth among states measured by research spending as a share of GDP. Arizona, which the business lobby points to as the model Oregon should follow, has lost ground despite increasing its state subsidies. In fact, their standing among states for research dropped from 14th to 21st place in the decade after they increased their R&D tax credits by 4%.

A revived R&D credit, in any form, would cost Oregon’s General Fund tens if not hundreds of millions of dollars and benefit fewer than 200 businesses.

If you attend a town hall or write a note to your legislators, ask them which states got boosts in R&D after they enacted R&D tax credits. We’ve been unable to discern any relationship. Big, small, none—credits don’t appear to matter.

Other bills would subsidize preparing farmland for industrial development. When a homebuilder buys 100 acres, puts in all the infrastructure (grading, water, sewer, utilities, roads, sidewalks, lights), it recovers its costs in the price of the homes. Industrial developers recovered costs the same way through the 1990s. For example, Washington County’s Westmark Business Park was developed on former farmland in 1997 and filled by 2015 with its businesses having borne all infrastructure costs.

But today there are two ways businesses avoid the cost. In one the property taxes of the new businesses are diverted from cities, counties, schools and libraries to pay for industry’s infrastructure as farmland now gets Urban Renewal Zone status. In another program, Regionally Significant Industrial Sites (RSIS), 50% of the income taxes of the new businesses’ employees are returned to the developer. In meetings and testimony, we’ve asked: Why are we absorbing the costs of getting the property shovel-ready when businesses purchase (or lease) property? Why is the public paying when they buy homes, and again when they arrive at work?

The new model for getting the public to pay is clear in the Hillsboro Technology Park which sits on 822 acres of former farmland. It is zoned for industrial development and inside the Urban Growth Boundary. It is in an Enterprise Zone, an Urban Renewal Zone, and under a contract for a RSIS subsidy.

We want businesses themselves to pay for infrastructure, not their employees, whose tax payments otherwise pay for the services they require as county residents.

And then there’s Enterprise Zones. The Oregonian has published a series explaining how the state subsidizes Amazon facilities (that compete with local businesses) and Washington County data centers. But when Amazon wanted to build its massive structure just west of I-5, Woodburn didn’t give it a property tax exemption and insisted that the business make road and other infrastructure improvements with its own money. Guess what? The retail Goliath went ahead, without subsidies, because it needs to be close to its customers.

In a 2022 report (p. viii) commissioned by Business Oregon, Long Term Rural Enterprise Zones (LTREZ) have had a poor return on investment. But legislators (most of them Democrats) introduced seven bills to extend E-Zones without changes. Only one bill, based on our recommendations, would make any changes. The others all extend the 3-5 year and the 15 year Enterprise Zones without changes, some with extensions until 12 years from now!

And then there’s Gain Share, that unique idea out of Hillsboro that because they’ve given up property taxes for Intel, Genentech and others they should be rewarded with 50% of the income taxes of the new employees at the businesses. Nevermind that 32% of the property taxes they choose to give up are essentially state money because of the way the funding formula works for K-12, Community Colleges and ESDs. Gain Share too is facing a sunset. We offered legislators a chart showing that many communities are collecting in fees and taxes most of what they would get from the businesses they didn’t offer SIP property tax breaks. We testified that Gain Share doesn’t make sense but at least should see changes if they don’t choose to just let it disappear.

Democracy is work

February 15, 2023

Tax Fairness Oregon volunteers have been working every day since the legislative session began, reading bills, testifying before committees and lobbying members. Communicating with our membership has taken a backseat. Here is a diary entry—February 9—from one of our active members, Bennett Minton.

Democracy is work

This is Dylan and Nick, students at Oregon State and Oregon. We had just testified in the Capitol on a bill that, as we recommended be amended, is the next step in securing more efficient funding for the state version of Pell Grants. I estimate our chance of passage of our proposal—one TFO began developing a year ago—at 80%. (It is really hard to pass a bill.)

I had testified before three other committees earlier in the day, each of them considering bills that would make things better or worse for the state’s residents. It was the most satisfying workday I’ve had in my formerly paid profession in 29 years, since I was an aide in Congress.

My first hearing of the day was supposed to consider an amendment that the committee chair had directed be drafted per our suggestions in a hearing two weeks ago. The bill would hand out $1,000 to every qualifying volunteer firefighter (Oregon has about 8,000), ostensibly to aid recruitment and retention. The problem is that a few counties—the legislature hasn’t asked for a list, so we don’t know which counties—lack the money to pay for training and equipment, so their volunteers are expected to pay thousands of dollars out of their own pockets for serving their fellow citizens.

The counties lack the money because of decisions the legislature and the voters have made over the past 30 years to slash taxes that fund local governments. Property taxes are essentially frozen (plus a 3% annual increase) because of a voter initiative in the 1990s. The legislature has eliminated most taxes timber companies used to pay, reasoning that growing trees is just like growing strawberries; we don’t tax strawberries, so we shouldn’t tax timber harvests. (Which allows forest owners, most of which are corporations, to treat their property as an asset of no value other than fruit.) And Oregon has no sales tax, a prime local revenue source in many states.

I wouldn’t expect most legislators to take on Oregon’s disastrous tax code. But just one might search for a solution to the firefighter shortage rather than issue press releases. Instead, legislators propose handouts for shortages of all kinds of workers, especially in the rural areas where voters routinely reject local tax initiatives. Every session, my colleagues and fellow TFO, volunteers read every bill looking for tax giveaways, and testify against handouts that don’t work.

When I arrived, the chair said he would not take up my amendment to jigger with the handout because the sponsor refused it. But he allowed me to testify. I told the committee, whose jurisdiction includes emergency response, that it lacked the information needed to devise an effective solution to the problem the bill pretends to address: Which counties don’t pay for firefighter training? The committee will refer the unchanged bill to another committee, and I’ll repeat the argument.

Next I testified on a bill that would raise the exemption for the state estate tax. It was the second time in two weeks I had testified on a bill to give heirs tax-free inheritances:

“Some 15 estate tax bills have been introduced this year. Their sponsors attend to those who won the birth lottery and stand to inherit more than $1 million [the current estate tax exemption]. If we housed our citizens, paid our teachers appropriately, supported our police forces adequately, had a mental health service system not ranked 50th among the states, subsidized colleges the way we did 40 years ago so that graduates didn’t carry crushing debt burdens, and provided a functioning criminal justice system with constitutionally required public defense attorneys, we might relate to their concern. But compared to any other crying need in our society, these bills don’t rank.”

Next, a bill to provide grants to rural newspapers in information deserts. For an hour witnesses told the committee that without informed citizens, democracy dies. A high school student said he loved journalism because growing up in rural Oregon, he hadn’t been allowed to watch the news or read the newspaper. I was there to testify against another part of the bill that would give tax credits to publishers of non-profit community newspapers—because the provision wouldn’t work. But the sponsor announced that provision would be struck, so I limited my remarks to my story: I have always been a reporter; my first job after college was working at a community paper in rural Virginia; a decade later I began the transition to tax policy analysis—a job I’m still doing, as a volunteer, three decades later. Here I was speaking about a bill to support that kind of newspaper because of my expertise in tax.

In between, I continued meeting with legislators to build support for a bill saving the state $25 million a year by disconnecting from the most outrageous federal tax giveaway ever, “Opportunity Zones.”

The college grants bill would extend a law under which sophisticated taxpayers can buy, at a discount, the tax credits that fund the grants. The auction proceeds go to the grants fund; the discount goes into the pockets of the tax-credit buyers. In this way, the buyers have siphoned $3.7 million from students over four years. Our proposal, which we’ve been explaining to the chairs of the six committees involved, would kill the auctions and fund the grants in the traditional way, through appropriations, which already provide 85% of the money. The chairs appear to be on board. (“This is dumb,” said the chair at the top of the hierarchy.)

If students can get a few more grants every year (actually several hundred) for the same money because I spent weeks getting legislators to join hands, that alone will have been worth my last five winters working the building.

Are rich people moving to Oregon?

February 4, 2023

Are rich people moving to Oregon or are the folks already hear just getting richer? Who knows. But statistics from tax filings show that the number of Oregonians with high incomes is up, really dramatically.

https://www.wweek.com/news/2023/01/25/even-during-pandemic-oregon-added-high-earners-at-rapid-clip/

Warehouse Tax Breaks

January 22, 2023

Since summer we’ve been having conversations with both legislators and the press about ending Oregon’s property tax breaks for warehouses and distribution centers. Clearly it’s working, we expect to bring changes to these enterprise zone programs in the coming legislative session with HB 3011.

In an Oregonian article Mike Rogoway points out that “…Amazon has collected more than $15 million in property tax savings on its warehouses in the Portland area and Salem since 2019. Other warehousing and transportation companies have saved an additional $4 million.”

“Whatever economic benefits the warehouses provide Oregon, the tax incentives were unnecessary to bring them to Oregon, says Jody Wiser of the watchdog group Tax Fairness Oregon.”

Further, says Deborah Field, co-owner of a Northeast Portland print shop called Paperjam Press.“I feel like our consumers, at least in Portland, really get it that they need to shop small or we’re not going to be around,” Field said. So it’s confounding to her that the state’s leaders don’t seem to feel the same way.

The bill makes modest other changes to Oregon’s enterprise programs and requires greater transparency.

Off to Salem: TFO circulates its priorities

January 14, 2023

The House speaker and the Senate president were elected without a hitch. Legislators were sworn in and started dropping bills. Some of them are ours, so we were off to Salem to start talking them up.

Semiconductor Incentives. The Biden administration is working to bring home manufacturing, and under the CHIPS Act, the Commerce Department will begin dispensing funding in the spring as part of the effort. The business lobby, led by the Oregon Business Council, has been pressing the legislature to hand out all kinds of goodies. One bill draft, for example, would create a “job creation tax credit” and a “family wage tax credit”—both paying any business that adds jobs and putting part of the cost on taxpayers. The draft also would revive and increase the research credit which the legislature let expire in 2017 at the governor’s recommendation and extend four tax expenditures 12 years without formal review.

Our message is that the tax code is an inefficient way to target spending. If the legislature wants to subsidize semiconductors, it should set a budget through the appropriations process. And semiconductor expansion should not be an excuse to circumvent the scheduled review of tax expenditures.

Unlike Governor Kate Brown, who embraced the Oregon Business Council’s agenda in total, Governor Tina Kotek has said she would support expenditures of $200 to $300 million. We’re waiting for details.

Enterprise Zones. We’ve been researching agreements under which the state allows counties to waive property tax payments in exchange for promises from businesses—and feeding our findings to The Oregonian, which has published a series on the abuses allowed under the agreements. What do we call an abuse? How about giving tax breaks to retailers like Amazon, which site their warehouses according to business necessity and then plead with local governments for tax gifts. In other cases, metro Portland jurisdictions have given tax abatements to data centers, which gobble up valuable land and have few employees. There are multiple bills to extend these enterprise zones with no changes.

We asked Rep. Dacia Graber to introduce HB 3011 which would make modest changes to Enterprise Zone programs. The bill would require more transparency, exclude retail warehouses (Amazon, UPS, etc.), shorten 15-year rural zone agreements, and in metro Portland deny benefits to low-employment-density buildings like data centers.

Opportunity Zones. In 2017 Congress created Opportunity Zones under the premise that tax-free income for rich investors would alleviate poverty in low-income neighborhoods. But most investments have been in real estate projects that gentrify neighborhoods, not create economic opportunity for the people who live in them. For example, the Portland Ritz-Carlton, financed with Opportunity Funds, replaced dozens of food carts with luxury condos (up to $8 million), hotel rooms and office space. Because Oregon is tied to the federal tax code, residents don’t pay state taxes on income from Opportunity Zone investments no matter what state they’re in.

We asked Rep. Andrea Valderrama, who was a Revenue Committee member in the last session, to reintroduce the bill we generated in 2020. (A version of the bill was scheduled for the House floor the day Republicans walked out, effectively ending the session.) HB 3909 would follow the example of several states that have denied corresponding state income tax benefits for their residents. Based on a recent congressional cost estimate, we think enactment would return to the General Fund more than $200 million that wealthy taxpayers have been able to defer paying over the past four years.

Opportunity Grants. The scholarships awarded to low-income students are funded two ways. In the current biennium, Opportunity Grants received $166 million through Ways and Means and an additional $14 million per year through auctions of tax credits. But the buyers of tax credits have siphoned $3.8 million that would have gone to students had the funding mechanism been through biennial appropriations.

SB 129 and HB 2075 would extend the tax credit auctions from 2024 through 2029. We are urging the Revenue committees to amend the bill and kill the auctions before another takes place in December and asking the Ways and Means Committee to make up the difference. Oregon has more outrageous examples of wasteful spending, but none is dumber.

These ideas would mark modest improvement. We expect to play defense on a bunch of terrible bills—soon. Vigilance.