Members of the TFO Steering Committee have been meeting since May with candidates running for the Oregon Legislature. Our goal? To help them understand some basic tax and revenue issues that they will be facing if elected.

Of the 75 districts up for election in November, 24 are guaranteed to be won by newcomers, many of whom may have limited knowledge of Oregon’s tax system and financial structure.

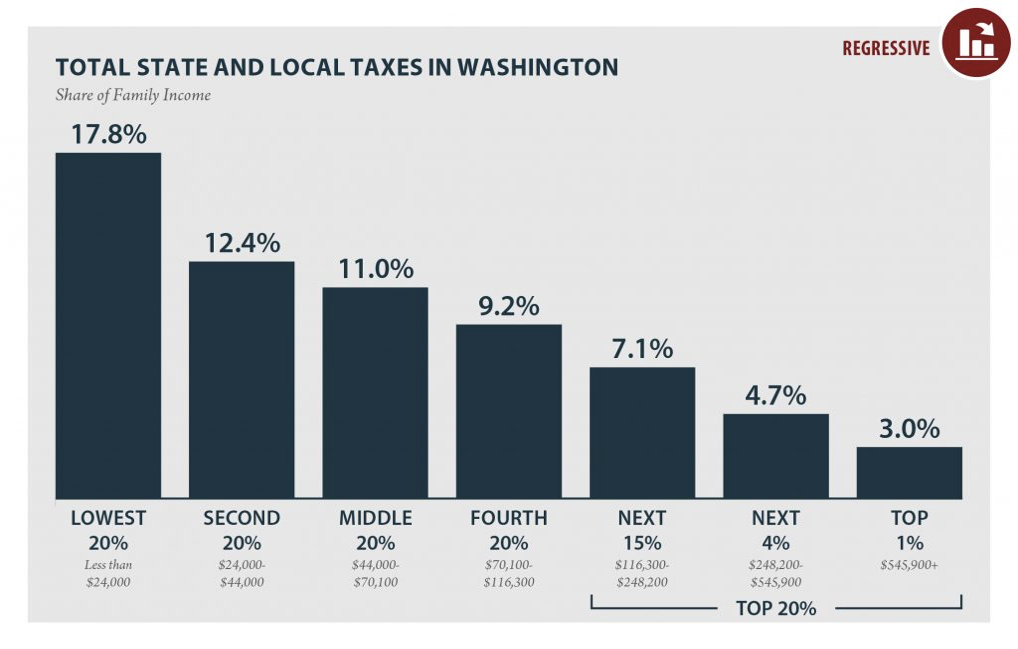

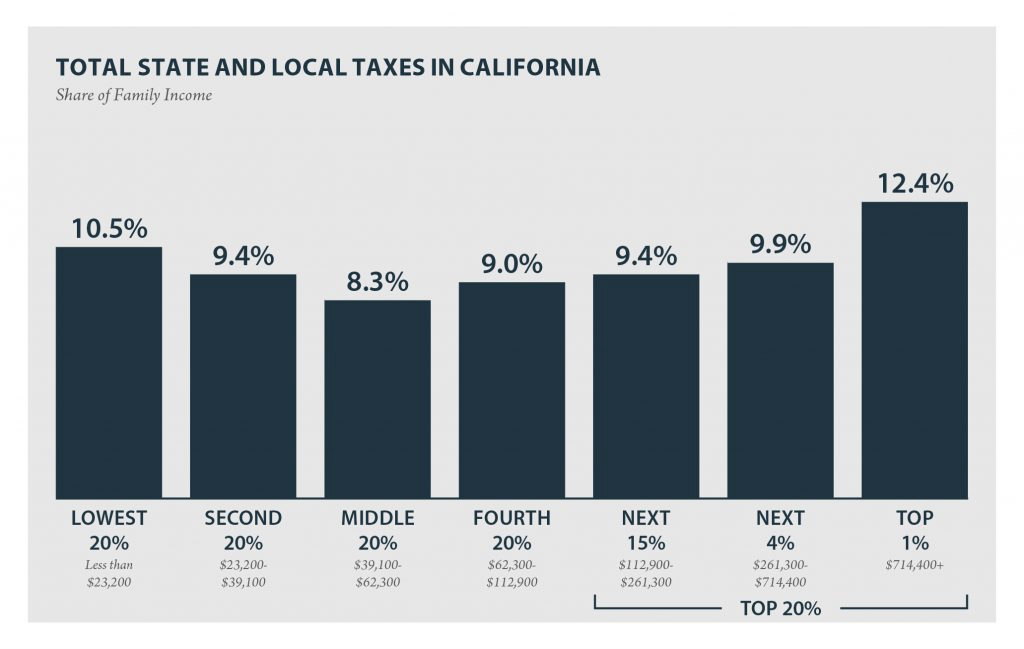

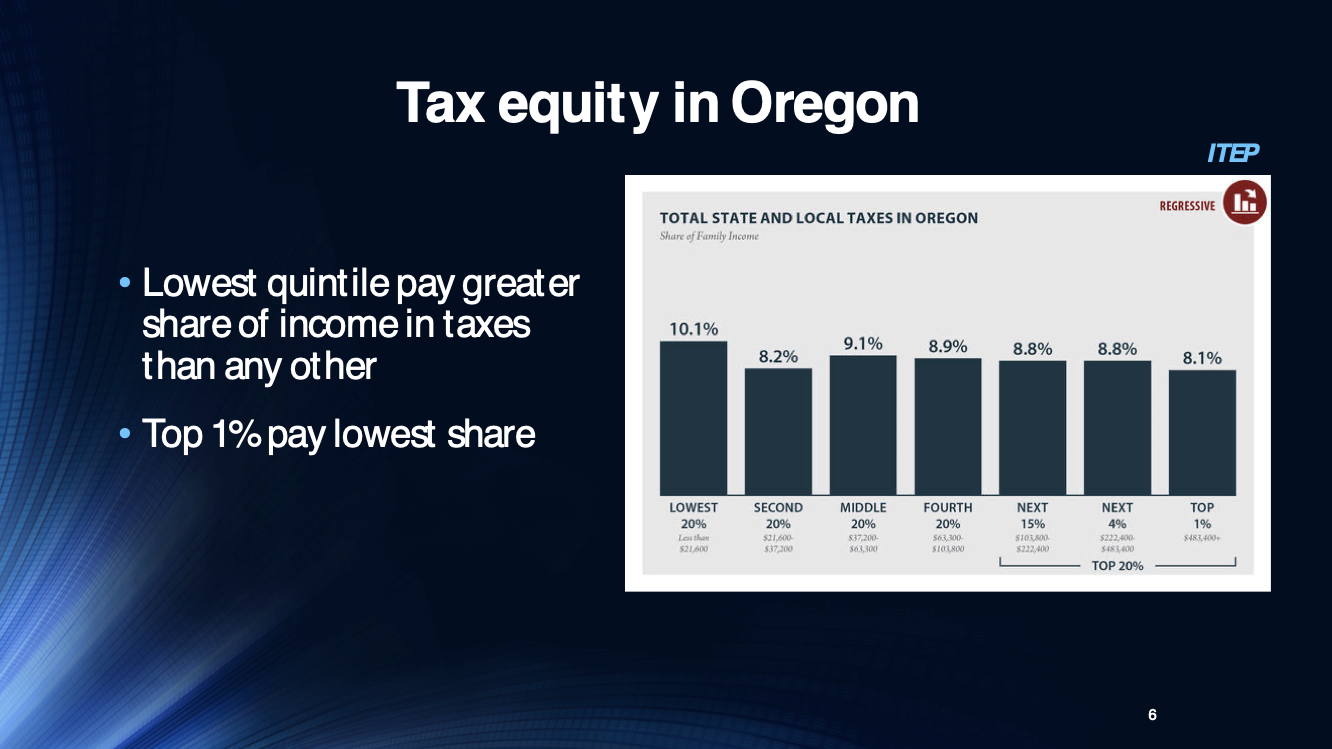

TFO uses this PowerPoint TFO Revenue Basics 2022 as we discuss Oregon’s tax policy principles and funding mechanisms. Our presentation includes these charts that show how Oregon compares to our neighboring states, in terms of tax fairness by family income bracket. The charts were prepared by the Institute on Taxation and Economic Policy (ITEP) in 2018, so they are a bit dated. But it’s clear if one reads ITEP’s Who Pays that Oregon sits geographically between the most regressive state and the most progressive state in the nation according to their analysis. ITEP includes state and local income, property and sales taxes along with fees in their analysis.

Oregon is in the middle—more progressive than Washington, but less Progressive than California.

Our intention is to help potential legislators consider who wins and who loses when tax code choices are made.

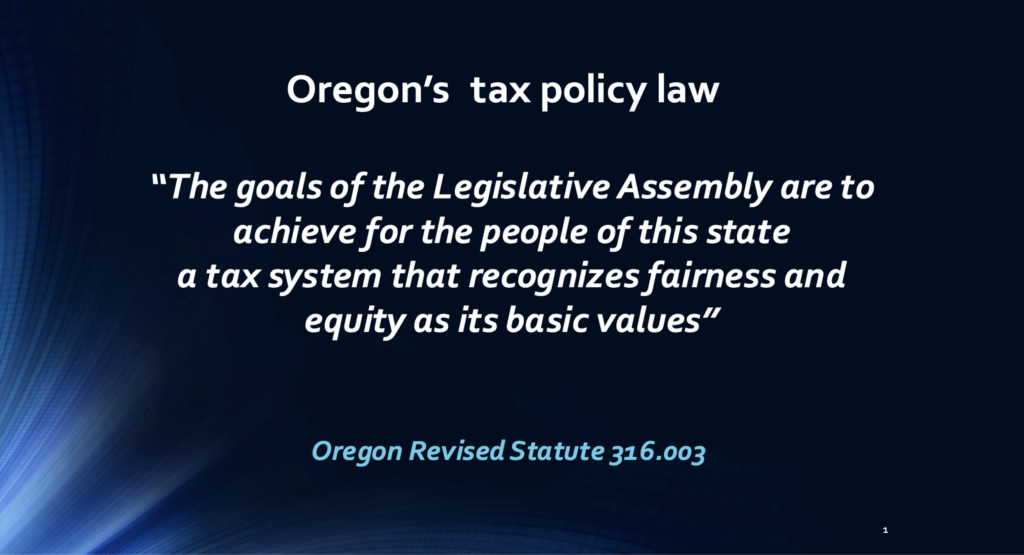

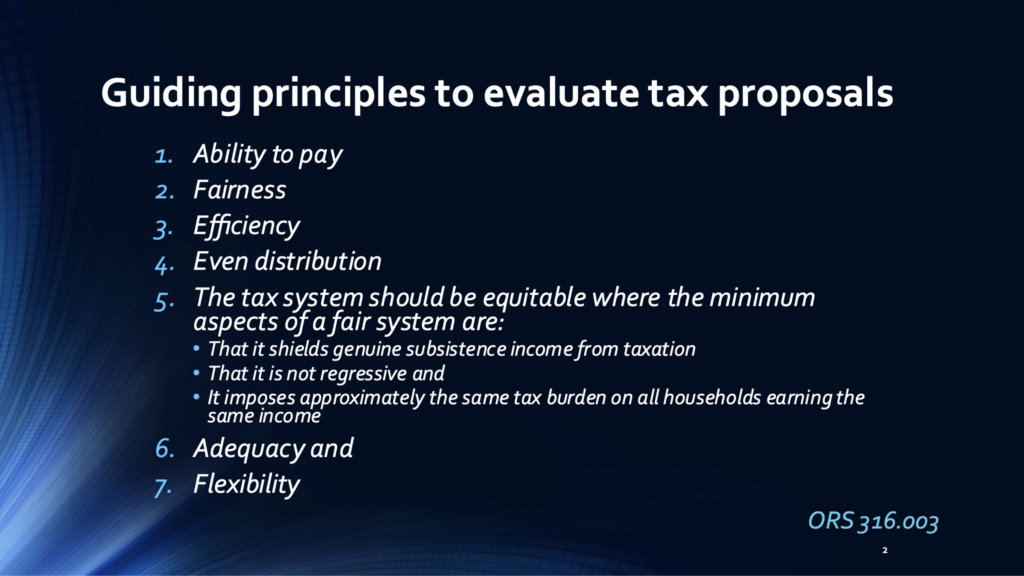

We also point out that TFO’s objectives are in alignment with Oregon’s tax policy law:

To learn more or to help TFO with these efforts, please give Josie Koehne a call at 503 866-3346.